Explore the U.S. auto parts market: amazon sales could top $6.3 billion

19-02-27

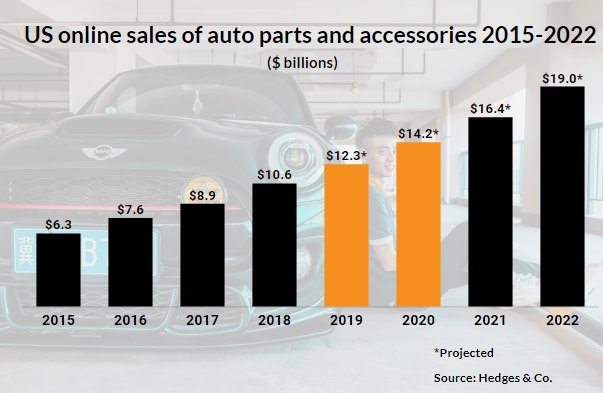

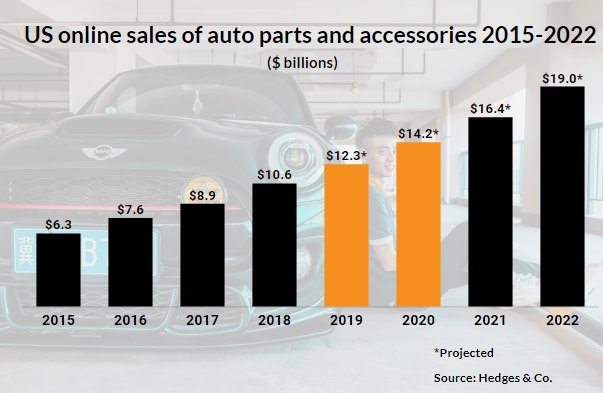

An analysis by Hedges & Co, a digital car marketing company, suggests that the us market for electric car parts will grow by about 16 per cent to $12.3bn in 2019. Most of those sales will be on smartphones.

(photo shows the online sales of auto parts in the United States from 2015 to 2022)

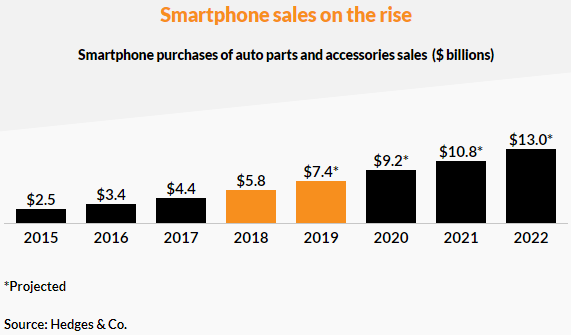

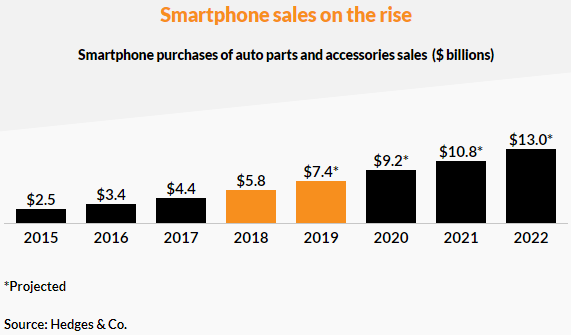

In 2019, mobile sales of auto parts will exceed $7.4 billion, accounting for about 60.2 percent of the total sales, up 27.6 percent from $5.8 billion in 2018. That's exactly what happens with auto-parts retail sites, which account for more than 60% of total traffic on mobile, Hedges & Co said. According to Hedges & Co, the market for mobile electric vehicle parts will grow at an average annual rate of 25% until 2022.

(the picture shows the mobile sales of auto parts products from 2015 to 2022)

According to Hedges & Co, amazon expects to sell $6.3 billion worth of auto parts, accessories and car care products in 2019, as well as $1.6 billion worth of replacement parts made by original equipment manufacturers (oems), so total sales are expected to reach nearly $8 billion.

"The aftermarket is really catching up with the rest of the world," said Jon Hedges, President of Hedges & Co.

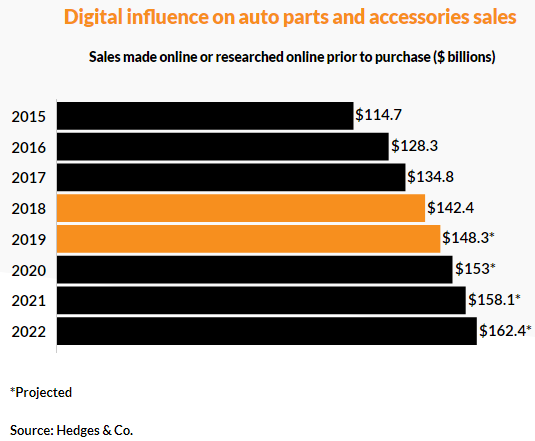

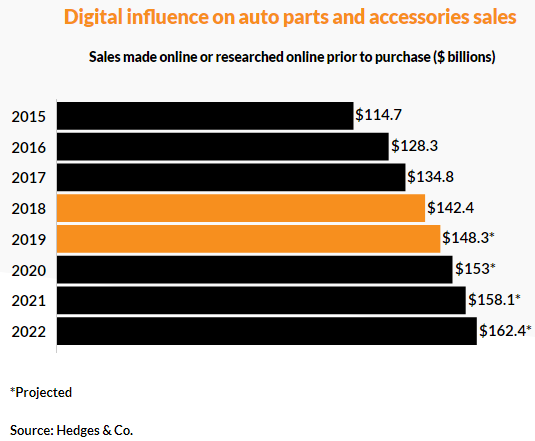

Digital activity will drive sales of auto parts in the United States to just over $148 billion this year, the analysis said. These "digital influenced" sales include goods bought online and those studied and found online before they are bought in a store. Hedges & Co projects that online sales of us motor parts will reach $19bn by 2022, and digital-influenced sales will rise to $162.4bn.

Hedges said the online sales and digital influence of the sector is growing as sellers increasingly shop online for auto parts, and auto parts retailers are doing better in e-commerce and giving consumers a better online experience than in the past few years.

In addition, a growing number of auto parts manufacturers now sell directly to consumers on their websites. Some well-known brands are included, such as Edelbrock LLC, Flowmaster Mufflers, Holley Performance Products, WeatherTech Direct LLC and Westin Automotive. That, Hedges notes, makes perfect sense, because consumers of auto parts go to manufacturers' websites anyway.

(the picture shows the sales of automobile parts affected by digitalization from 2015 to 2022)

“consumers in the automotive aftermarket tend to be keen on research. ”So Hedges. This is because consumers must determine whether a particular part is appropriate when repairing or restoring a car. Otherwise, even if the buyer can choose to return the item for a refund, the purchase is a waste of time. To get the certainty they need, most consumers go to the manufacturer's website for detailed information about the parts they want to buy. As a result, more people will use the websites of auto parts retailers in the future.

Hedges & Co says that about 90 percent of consumers do some form of online testing before buying new kit. Even if they do end up buying in a store, they research online beforehand. Popular sources of research for consumers were online search engines (74% of total consumers), auto-parts retailer websites (73%), manufacturers websites (57%) and automotive BBS (47%), according to Hedges & Co.

According to Hedges & Co, online sales of Canadian auto parts will total about $2.9 billion in 2019, compared with $700 million in Mexico and $15.9 billion in North America.

The Hedges & Co Analysis combines specific research, the U.S. Census Bureau and U.S. Bureau of Economic Analysis, third-party data that USES statistical modeling, and interviews with industry leaders and celebrities. The company's annual forecast for the U.S. auto parts market in 2019 includes only online sales of newly produced and remanufactured auto parts, a total that excludes third-party sales on amazon, eBay Motors or other third-party platforms.

(compiled by Hugo Chen xiaoru)

(photo shows the online sales of auto parts in the United States from 2015 to 2022)

In 2019, mobile sales of auto parts will exceed $7.4 billion, accounting for about 60.2 percent of the total sales, up 27.6 percent from $5.8 billion in 2018. That's exactly what happens with auto-parts retail sites, which account for more than 60% of total traffic on mobile, Hedges & Co said. According to Hedges & Co, the market for mobile electric vehicle parts will grow at an average annual rate of 25% until 2022.

(the picture shows the mobile sales of auto parts products from 2015 to 2022)

According to Hedges & Co, amazon expects to sell $6.3 billion worth of auto parts, accessories and car care products in 2019, as well as $1.6 billion worth of replacement parts made by original equipment manufacturers (oems), so total sales are expected to reach nearly $8 billion.

"The aftermarket is really catching up with the rest of the world," said Jon Hedges, President of Hedges & Co.

Digital activity will drive sales of auto parts in the United States to just over $148 billion this year, the analysis said. These "digital influenced" sales include goods bought online and those studied and found online before they are bought in a store. Hedges & Co projects that online sales of us motor parts will reach $19bn by 2022, and digital-influenced sales will rise to $162.4bn.

Hedges said the online sales and digital influence of the sector is growing as sellers increasingly shop online for auto parts, and auto parts retailers are doing better in e-commerce and giving consumers a better online experience than in the past few years.

In addition, a growing number of auto parts manufacturers now sell directly to consumers on their websites. Some well-known brands are included, such as Edelbrock LLC, Flowmaster Mufflers, Holley Performance Products, WeatherTech Direct LLC and Westin Automotive. That, Hedges notes, makes perfect sense, because consumers of auto parts go to manufacturers' websites anyway.

(the picture shows the sales of automobile parts affected by digitalization from 2015 to 2022)

“consumers in the automotive aftermarket tend to be keen on research. ”So Hedges. This is because consumers must determine whether a particular part is appropriate when repairing or restoring a car. Otherwise, even if the buyer can choose to return the item for a refund, the purchase is a waste of time. To get the certainty they need, most consumers go to the manufacturer's website for detailed information about the parts they want to buy. As a result, more people will use the websites of auto parts retailers in the future.

Hedges & Co says that about 90 percent of consumers do some form of online testing before buying new kit. Even if they do end up buying in a store, they research online beforehand. Popular sources of research for consumers were online search engines (74% of total consumers), auto-parts retailer websites (73%), manufacturers websites (57%) and automotive BBS (47%), according to Hedges & Co.

According to Hedges & Co, online sales of Canadian auto parts will total about $2.9 billion in 2019, compared with $700 million in Mexico and $15.9 billion in North America.

The Hedges & Co Analysis combines specific research, the U.S. Census Bureau and U.S. Bureau of Economic Analysis, third-party data that USES statistical modeling, and interviews with industry leaders and celebrities. The company's annual forecast for the U.S. auto parts market in 2019 includes only online sales of newly produced and remanufactured auto parts, a total that excludes third-party sales on amazon, eBay Motors or other third-party platforms.

(compiled by Hugo Chen xiaoru)